In the world of fund administration, the value of effective financial tools can't be overstated. As fund administrators cope with sophisticated transactions, journey charges frequently emerge as a major issue. which item is really a good thing about utilizing the vacation card in fund administration? In this article, we will check out the many advantages of applying vacation cards inside the fund administration field and emphasize how these cards can streamline procedures, enrich Handle more than expenses, and provide financial transparency.

Introduction: The Role of Journey Cards in Fund Management

Fund management includes overseeing investments on behalf of customers or organizations, which regularly contains journey for conferences, conferences, and investigation. Which product is a benefit of using the vacation card In this particular context? Vacation cards, generally offered by monetary institutions, are especially meant to deal with company-connected travel bills. These playing cards offer an productive Alternative for managing and tracking journey-relevant costs, producing them a essential tool on earth of fund administration.

In a fast-paced, large-stakes ecosystem like fund management, holding keep track of of each penny is important. Vacation playing cards supply various Rewards, particularly when running shopper money or working in a finances-aware framework. Enable’s take a better take a look at which item is actually a advantage of using the vacation card in fund administration.

Simplified Expense Monitoring

Among the most significant great things about utilizing a journey card in fund administration could be the simplified monitoring of costs. Which item is a good thing about utilizing the vacation card below? Travel cards include in depth reporting and categorization attributes that make it simple to track shelling out. Just about every transaction is recorded in serious-time, as well as the stories might be simply exported, allowing for fund supervisors to accessibility in-depth financial statements that align with their accounting devices.

Utilizing a journey card removes the necessity for handbook monitoring of costs or the effort of amassing receipts. This characteristic is particularly important in fund administration, the place meticulous document-retaining is important to take care of transparency and ensure compliance with interior and external auditing needs.

Improved Management Above Paying out

Which item is a good thing about utilizing the journey card when it comes to controlling investing? Travel cards supply fund administrators with higher control about the expenditures incurred all through company journey. With customizable expending limits, fund professionals can set predefined quantities for distinct classes, which include foods, transportation, and lodging. This assists in order to avoid overspending and ensures that the business adheres to its spending plan constraints.

Also, travel playing cards typically allow for authentic-time tracking from the equilibrium, providing fund administrators immediate access to financial information. This level of control aids mitigate the risk of unauthorized or extreme spending and makes certain that funds are made use of successfully.

Increased Safety features

Which item is often a good thing about using the vacation card when it comes to safety? Stability is often a significant concern in almost any fiscal transaction, and journey playing cards provide a number of features meant to protect both of those the cardholder as well as the Group. Most vacation playing cards come with State-of-the-art protection protocols, like encryption, fraud monitoring, and alerts for uncommon exercise. These options are important in preventing unauthorized obtain and mitigating the chance of fraud.

Also, if a journey card is lost or stolen, it may be simply noted and deactivated, blocking any further more fraudulent transactions. view This level of stability is especially worthwhile in fund administration, exactly where economical transactions must be closely monitored and safeguarded.

Seamless Integration with Fund Administration Programs

Which item is usually a advantage of using the vacation card When thinking about integration? One more important benefit of working with vacation playing cards in fund management is their capability to integrate seamlessly with fund management programs. Most vacation card vendors present resources and application that can automatically sync with the Group’s accounting or ERP (Company Resource Organizing) technique. This removes the need for handbook data entry and makes sure that all travel-similar bills are properly recorded.

By integrating journey card use into your fund administration methods, you'll be able to accomplish bigger operational performance and minimize the probability of human mistake. This integration delivers a streamlined approach to money reporting, which makes it easier for fund administrators to keep up an correct overview of vacation charges and adhere to budgetary constraints.

Rewards and Incentives

Which product is really a advantage of utilizing the travel card when it comes to benefits? Lots of vacation playing cards give benefits or incentives, including details For each dollar spent, which can be redeemed for foreseeable future journey, services, or simply cashback. For fund administration corporations that regularly incur journey-linked expenses, these rewards can include sizeable worth.

Whilst the rewards shouldn't be the principal motivation for employing a travel card, they might aid offset long term journey costs and lead to a more Price-effective operation. This tends to make travel cards not just a Software for expense administration but additionally a possible supply of economic advantage.

Simplified Reconciliation and Reporting

Which item is really a advantage of utilizing the travel card regarding financial reconciliation? Journey playing cards simplify the reconciliation process by routinely providing thorough transaction documents. This eliminates the necessity for fund administrators to manually compile receipts or reconcile price stories, conserving valuable time and lowering administrative burden.

The reporting abilities of vacation cards allow for easy categorization of expenses, enabling fund professionals to immediately make reviews and evaluate paying out patterns. This is very useful when planning fiscal statements for shoppers or investors, making certain that each one travel costs are effectively accounted for and aligned with funds projections.

Enhanced Transparency and Accountability

Which product is a good thing about utilizing the vacation card in relation to transparency? On the list of most important great things about using a vacation card in fund administration could be the greater transparency it offers. With each individual transaction quickly recorded, fund administrators can certainly check in which and how money are being spent. This degree of transparency is essential for protecting have confidence in with clientele and traders, who be expecting a transparent breakdown of charges.

Travel cards also provide a very clear audit path, and that is important for accountability. During the party of the economic review or audit, having an in depth record of travel expenses makes certain that all transactions are reputable and compliant with organizational insurance policies and polices.

Conclusion: Which Item Is actually a Good thing about Using the Vacation Card in Fund Administration?

In conclusion, which product is really a advantage of utilizing the vacation card in fund administration? The benefits are a lot of, starting from simplified cost tracking and enhanced Regulate about investing to Improved security and seamless integration with fund management techniques. Travel playing cards are a must have tools for fund administrators looking to streamline their financial procedures, lessen administrative get the job done, and make certain greater accountability and transparency.

What's more, a chance to earn rewards and incentives for business-related journey adds Yet another layer of benefit, making travel playing cards an essential monetary Device for people working in fund administration. By leveraging the benefits of vacation playing cards, fund administrators can enhance their fiscal operations, enhance their reporting accuracy, and ultimately obtain much better results for their consumers.

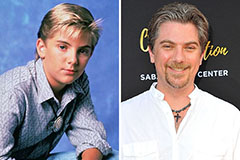

Ben Savage Then & Now!

Ben Savage Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!